Exploration, a Multi-Stage Process

Updated on 12.08.20235 min read

Exploring for oil and gas deposits is a lengthy, complex, expensive process performed by multidisciplinary teams of specialists: geologists, engineers, technicians, economists and advisors in international negotiations.

© Giuseppe Ramos Y

The Licensing Round

It usually starts with an international licensing round organized by the government of a country that wants to unlock the value of its natural resources. It uses this method to select oil companies offering the best terms.

The company selected — either alone or in a joint venture or with others — is awarded an exploration license that it will either execute or sell or swap in a global market.

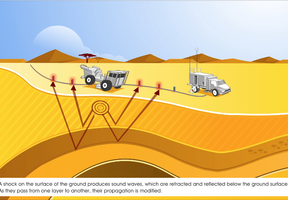

The first phase of exploration of the prospect, or , consists of scanning the subsurface. Seismic waves, generated by thumper trucks or airguns , are sent through the subsurface. Reflected at different speeds by each rock layer they encounter, the waves are analyzed to produce 2D or 3D images. This technique, , has become increasingly precise thanks to the significant strides in information technology.

However, seismic imaging is never 100% accurate or reliable. The data acquired are supplemented by available surveys of the regional geology and the results of neighboring sites. While all these data help to reduce uncertainty about whether or not a prospect exists, the decision to drill a well is always a difficult one.

Costs Borne by the Companies

It costs at least €3 million to €4 million to drill an exploration well onshore, and ten times more offshore. The average success rate is just one in three. The companies bear all costs. If the exploration results in a commercial discovery, the investment pays a return. But if it does not, the company loses its investment.

This is where economists come in, to calculate the value of the potential deposit by factoring data such as the price of oil and the tax system in the country concerned. If their simulation is negative, the prospect will not be drilled.

Exploration and Appraisal Drilling

Then comes exploration drilling, in which a bores into the subsurface, bringing with it a string of drill pipes screwed together. Meticulously prepared brings up rock cuttings and hydrocarbon samples that will confirm — or not — the discovery of a deposit and will provide additional information about whether the reservoirs can be developed. During drilling, the reservoir study is fine-tuned by measuring the porosity of the rock, subsurface fluids and even the natural radioactivity of the rock.

A number of appraisal wells are usually drilled on the same site to accurately delineate the reservoir and check its properties, as well as select the best location for future production wells.

All these steps are critical to determine whether the deposit is commercial and calculate its profitability.