Egypt: The Promise of Zohr

Updated on 05.26.202310 min read

Despite the political turmoil that has rocked the country since the start of the century, Egypt’s economy has continued to grow at a solid pace: 5% a year before 2011, followed by a weaker, but never below 2%, increase after the fall of President Mubarak. Since General Sisi has come to , growth has returned to around 4% a year, and the World Bank is forecasting that this figure will rise to up to 6% a year beginning in 20171. And that despite a sharp drop in tourism.

© GUILLAUME PERRIN / TOTAL - Egypt has great hopes for the natural gas operations off Port Saïd. This photo shows an offshore platform.

Egypt’s strong economic growth is barely sufficient to keep up with its surging population (80 million inhabitants in 2010, 95 million in 2017), a situation aggravated by a shortage of habitable land (7% habitable, 93% desert). As a result, nearly one-third of the Egyptian population still lives below the poverty line. consumption is rising sharply: up 70% from 2000 to 2010, followed by an average annual increase of 6.5% that is expected to continue until 2020.

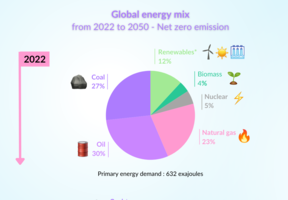

With almost 80% of its electricity sourced from gas-fired power plants, Egypt, once an exporter of natural gas, had to import gas from Algeria, the Gulf and Russia, and even that wasn’t enough to fully meet domestic demand. Incessant power cuts, especially during the summer, have been a huge drag on industry and a source of ire among the population, prompting the president to make energy development a priority objective.

The Discovery of the Zohr Gas Field

After having studied various options, embarked on a nuclear power project with Russia’s Rosatom and unveiled a program, the Egyptian government received excellent news in 2015: the Italian oil company Eni announced the discovery of a colossal natural gas field with an estimated 850 billion cubic meters of gas off the coast of Port Said, under 1,500 meters of water. The resources would be enough to satisfy domestic demand for several decades and allow Egypt to start exporting again and bring in foreign exchange revenues. The field was named Zohr.

Zohr’s discovery wasn’t surprising in this part of the eastern Mediterranean, where the existence of major fields has been known for a long time. Two large natural gas fields, Leviathan and Tamar, were discovered in Israeli waters at the end of the 1990s. Cyprus, for its part, claimed its rights to the Aphrodite gas field. Gaza too is entitled to develop its maritime zone.

Egypt has pressured Eni to step up the exploration and development of Zohr. Eni sold a 10% interest in the field to BP, which already has extensive operations in Egypt. Production at phase 1 is set to begin in October 2017. Eventually, the field is expected to produce 30 to 35 billion cubic meters of gas per year (Egypt’s current production is about 60 billion cubic meters).

If Zohr delivers on its promise, Egypt may decide to put the brakes on other projects, even if some of them are already quite advanced.

Nuclear and Renewables

Egypt has been looking at for a very long time, and in 2010 it launched a tender for a nuclear power plant in Dabaa, west of Alexandria, in the desert area bordering Libya. In November 2015, it signed an agreement with Russia’s Rosatom for a plant with four 1,200-megawatt reactors that is set to come on stream in 2025.

The government hopes to produce 20% of its electricity from renewable energies by 2020. It also intends to build solar and wind power plants with a combined capacity of 4,300 megawatts over the next three years.

The Weight of Geopolitics

Egypt’s energy policy also depends on regional geopolitics and the balance of power between Iran, Iraq and the Gulf states.

During the last two years, Egypt and Saudi Arabia have been working on an ambitious power grid interconnection project aimed at improving the countries’ capacity to meet demand, especially during peak periods. The idea is similar to the one behind the Mediterranean Electric Ring, a project involving several European power utilities. Egypt and Saudi Arabia have also signed a five-year oil supply agreement.

In 2016, however, relations between the two countries were strained by a diplomatic dispute. The Saudi Arabian oil company Aramco halted its oil shipments to Egypt, forcing the latter to turn to the international markets to secure its needs. As of early 2017, the situation remained blocked. The electricity project is moving forward, however, with interconnection planned to begin in early 2019.

Sources :