Oil Companies become Multi-Energy Companies

Updated on 04.20.202310 min read

The historical oil companies - the - have seen a century of significant changes. First, in their relations with producing countries. Then in their actions for the “energy transition”. Today, they are becoming “multi-energy” producers and distributers of gas and to end users.

© Giuseppe Ramos G

The First Decades

Everything started in the 19th century, in 1859, when the American Edwin Drake extracted oil by for the very first time in Titusville, Pennsylvania.

Two major companies began to gain ground: Standard Oil founded by the American John Rockefeller, and Shell founded by the British industrialist Marcus Samuel. In 1911, Standard Oil became so powerful that the American Congress voted an anti-trust law1 obliging the company to break up into several independent companies.

World War I (1914-1918) saw oil promoted as the driver of economic development. Seven oil companies dominated the world stage and were known as the “Seven Sisters”: Exxon, Mobil, Socal, Texaco, Gulf, BP, and Shell. In 1924, the Compagnie Française des Pétroles (CFP) - which much later down the line became Total - joined the seven.

In July 1928, five oil companies (BP, Shell, Exxon, Mobil, & CFP) signed the Red Line Agreement, in which they divided among themselves the oil resources in the former Ottoman Empire (i.e. from Palestine, through Iraq to the Arabian Peninsula).

This led to the creation of several private local companies in the Gulf, called “consortiums”, which allowed the companies to pool their prospection resources and liaise with local authorities. After the Second World War, the share of oil revenue paid by the consortiums to the countries where the oil fields were located considerably increased, but this did not affect the Seven Sisters’ profits.

The 1973 Oil Crisis

The 1973 war between Israel and the Arab countries triggered an initial oil crisis that caused prices to rocket.

Aware of their new geopolitical influence, the oil-producing States wanted to take control of the production of their oil & gas resources. Gradually, the major oil companies had to hand over their oil field production rights, and little by little, the consortiums they had founded became nationalized. Among them, Aramco became the National Saudi Company and the leading world oil producer.

National oil companies decided to strike up partnerships with global companies likely to produce and drew up concession or production-sharing contracts.

The 21st century: toward multi-energy companies

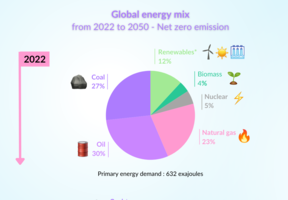

The need for an “energy transition” to tackle the risks of , led to a paradigm shift among the oil majors. It began at the end of the 20th century, with the strong development of gas-producing activities among the major oil companies. Since a gas power station emits approximately 50% less CO2 per kWh than a -fired power station, “gas appears to be a ‘cleaner’, though temporary, alternative, for countries that rely heavily on coal and who are now joining the energy transition”2.

They then diversified into other energy sectors such as biofuels, solar power, wind, CO2 storage, batteries, and so on. As early as the 1980s, BP began activities in solar power and onland . The Dutch company Shell was one of the first to start wind activities. In 2011, Total became the majority shareholder in Sunpower, an American manufacturer.

Thereby producing renewable electricity in an increasingly open market, these groups made the natural decision to serve the end customer, by becoming distributors. The Italian company ENI supplies electricity to French homes. Total’s buyout of Direct Energie in 2018 put the group in direct competition with Engie (formerly GDF-Suez) and EDF.

To mark the transition, the names of some of these companies were changed. The Norwegian giant Statoil became Equinor and Total has become TotalEnergies.

The move toward “multi-energy” activities is much more obvious in European multinationals than in North American Companies, as the later have become the leading world oil and gas producers and exporters of shale hydrocarbons.

_________________

1 Law that regulates the organization of very large businesses to promote competition and prevent unjustified monopolies.

2 “Where does gas fit into the energy transition? ”, analysis memo by France Stratégie.

The top 20 “multi-energy” companies

|

Company |

Country |

Turnover (in billions of dollars) |

|

Saudi Aramco |

Saudi Arabia |

400.38 |

|

Sinopec |

China |

384.82 |

|

PetroChina |

China |

380.31 |

|

ExxonMobil |

USA |

280.51 |

|

Shell |

United Kingdom |

261.76 |

|

TotalEnergies |

France |

185.12 |

|

BP |

United Kingdom |

158.01 |

|

Chevron |

USA |

156.29 |

|

Lukoil |

Russia |

125.11 |

|

Russia |

117.30 |

|

|

Valero Energy |

USA |

114.00 |

|

Phillips 66 |

USA |

111.70 |

|

Rosneft |

Russia |

111.40 |

|

EDF |

France |

99.83 |

|

Enel |

Italy |

99.41 |

|

E.ON |

Germany |

91.44 |

|

Eni |

Italy |

90.50 |

|

Equinor |

Norway |

88.37 |

|

Petrobras |

Brazil |

83.89 |

|

Engie |

France |

68,40 |

Source: Global 2000 from Forbes magazine. The Forbes Global 2000 is based on four indicators (turnover, profits, assets, market value). In this table, we have considered only the turnover (between April 2021 and April 2022).