United States: The World’s Leading Oil and Gas Producer

Updated on 12.08.202310 min read

The U.S. shale “revolution”, which began in the early 2000s, has seen the country become the leading producer of oil and gas in the world and an exporter of both resources, reducing its reliance on countries in the Middle East and strengthening its geopolitical position.

© GONZALEZ THIERRY - TotalEnergies - The development of shale gas in the United States has profoundly altered the world energy landscape.

The United States has been producing on an enormous scale since 2007 and extracting an increasing amount of since 2010, considerably boosting its output. In 2014, the country overtook both Saudi Arabia and Russia to become the leading producer of and natural gas.

This trend is set to continue and will ensure that the United States is energy self-sufficient in the coming years. The country already produces more gas than it consumes and has built gas facilities enabling it to export an increasing amount around the world. In terms of oil, the United States long produced as much as it consumed. But the country became increasingly dependent from the 1970s onwards, importing up to two-thirds of consumption in 2005. Today, consumption and production figures are almost equal.

Shale Oil and Gas Production

This revolution was made possible through the production of “shale”, and gas trapped in source rock that has not been able to migrate toward the surface and accumulate in standard deposits. Horizontal and (or “fracking”) must be used to release these resources. These techniques involve injecting large quantities of water and chemicals at high pressure into the ground to “break” the rock.

Drilling first focused on natural gas trapped in the source rock (shale gas) before extending to oil (shale oil). Two major production zones have gradually emerged: the Appalachian Basin in the north east, straddling Pennsylvania and Ohio; and the Great Plains in the center, spanning parts of Texas, Oklahoma, Colorado and Louisiana.

These techniques have attracted strong opposition from environmentalists, who say that fracking makes the ground unstable and that the chemicals used cause pollution. involves neutralizing vast expanses of land and providing access to fleets of trucks to bring in water and other necessary products. However, greater gas production has reduced the use of in generation, thereby curbing CO2 emissions.

Impacts on Gas Markets

Initially, major oil and gas producers such as Russia and the Gulf states paid little heed to rising U.S. outputs. They reasoned that the cost of extracting the unconventional hydrocarbon deposits would quickly outweigh the benefits. But American producers, often small companies, were able to adapt and reap the benefits of the technological advances that any new type of operation brings. In the petroleum industry, the cost of extracting shale oil was soon comparable to that of or hard-to-access oil production.

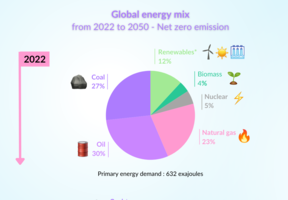

In 2019, the United States was responsible for 13% of the world’s oil output. Vying for market share is the Organization of the Petroleum Exporting Countries (OPEC), a cartel of 13 oil-producing countries which, working in collaboration with Russia, represents around 30% of global production.

One consequence of the shale gas boom has been lower gas prices on the North American market and, as a result, greater disparities with the other two major regional markets, Europe and Asia. Unlike the oil industry, the gas market is not yet globalized due to transportation difficulties. This secures U.S. industry access to extremely cheap natural gas, strengthening its competitiveness.